Mahatma Gandhi University Kottayam M.Sc Actuarial Science: Fees 2025, Course Duration, Dates, Eligibility

Course Description

Master of Science in Actuarial Science Colleges, Syllabus, Scope and Salary

M.Sc. in Actuarial Science is a 2-year long course divided into 4 semesters, minimum eligible qualification for which is a B.Sc./ B.Com. degree with a minimum aggregate score of 50%, with Mathematics and Statistics as two of the main subjects.

The course curriculum focusses on developing a unique blend of strong mathematical skills, real world business understanding, communication, interpersonal and leadership skills; all of which have been identified by the Actuarial Profession as core skills required by trainee actuaries. In addition to inculcating these attributes, this program also focuses on imparting quality education in the field of Insurance and Risk Management.

| Master of Science in Tamil Nadu | Master of Science in Maharashtra | Master of Science in Jammu and Kashmir | Master of Science in Uttar Pradesh |

The average tuition fee charged for the course in India ranges between INR 1 and 4 Lacs. Admission to the course is based on the candidate’s performance in a relevant entrance examination carried out by different universities, such as the Actuarial Science Entrance Exam, Institute of Actuaries of India Entrance Exam, and Actuarial Society of India Entrance Exam.

Some of the organizations that hire such postgraduates are General Insurance Companies, Health Insurance Companies, Actuarial Consulting Firms (including some of the Big 4 providing Actuarial Services), and Actuarial Back Offices (such as WNS, Mercer etc.)

They are hired in capacities such as Actuary Accountants and Auditors, Budget Analysts, Cost Estimators, Economists and Financial Analysts, among others.

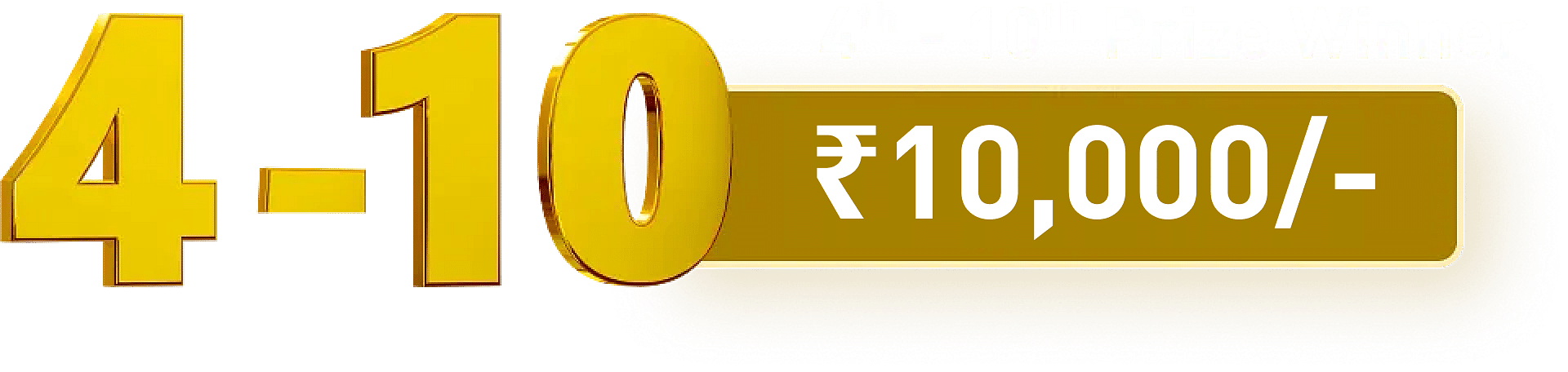

Average starting salary offered to such postgraduates ranges between INR 4 and 10 Lacs per year, increasing with experience in the field.

M.Sc. in Actuarial Science: Course Highlights

Listed below are some of the major highlights of the course.

| Course Level | Post Graduate |

| Duration | 2 years |

| Examination Type | Semester System |

| Eligibility | B. Sc./ B. Com graduates with 50% aggregate marks with Mathematics and Statistics as two of the main subjects |

| Admission Process | Based on entrance exams such as Actuarial Science Entrance Exam, Institute of Actuaries of India Entrance Exam, and Actuarial Society of India Entrance Exam etc. |

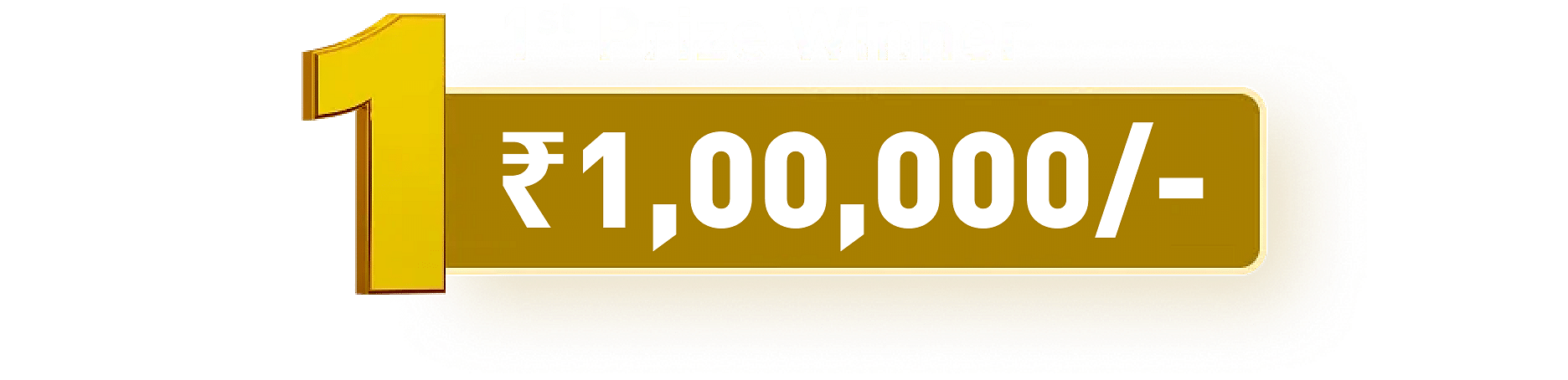

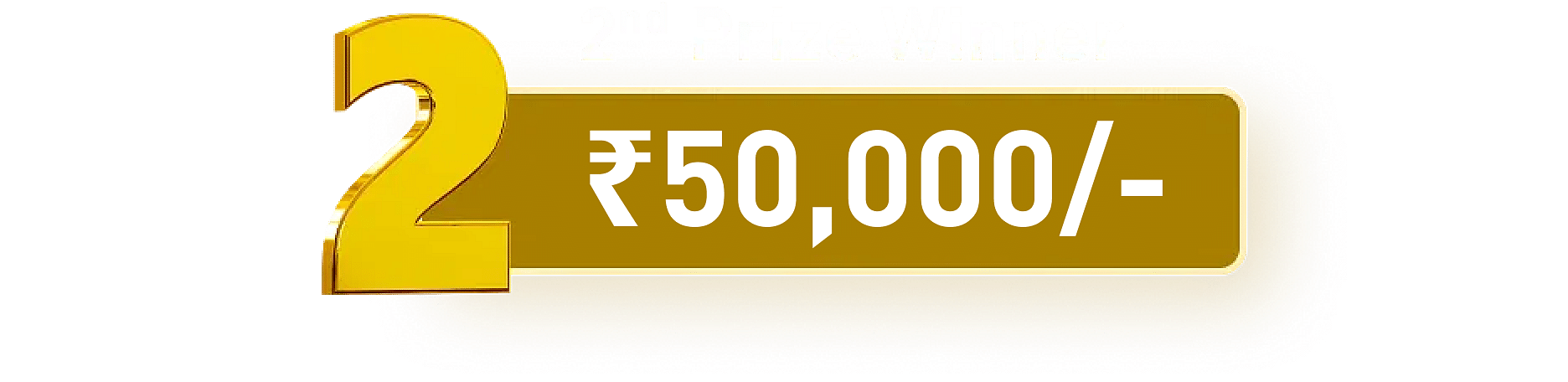

| Course Fee | INR 1 to 4 Lacs |

| Average Starting Salary | INR 4 to 10 Lacs |

| Top Recruiting Companies | Max Bupa Health Insurance, Bharati Shipyard Ltd., WNS, Towers Watson, PwC Actuarial Services India, Mercer |

| Job Positions | Port Manager, Chief Marine Engineer, Technical Superintendent, Marine Surveyor, Ship Operator and Second Marine Engineer etc. |

M.Sc. in Actuarial Science: What is it About?

The program essentially involves the application of analytical abilities to business. Topics such as Accountancy, Corporate Finance, and Economics are covered in the course curriculum, besides subjects such as Risk Management, Derivatives, and Insurance, Micro and Macroeconomics, Probability Theory, and Mathematical Statistics.

Actuarial Science includes components of Mathematics, Statistics, Economics and Finance. It has applications in the fields of Life insurance, General insurance, Health insurance, Reinsurance, Valuation of Retirement Benefits Viz. Gratuity, Pension, Leave Encashment Asset Valuation, Pricing of Securities and Derivatives, Risk Valuation, Risk Management etc. An Actuary is a financial problem-solver with a unique blend of mathematical, analytical and business skills. Actuaries, utilizing their mathematical and statistical skills, analyze past events, assess present risks and model the future. Actuarial skills are valuable for any business managing long-term financial projects both in the public and private sectors.

The program is designed to train eligible candidates in practical application of quantitative and problem-solving skills, offer them access to professionals in the industry, and exposure to current issues in the actuarial field.

Top Institutes Offering M.Sc. in Actuarial Science

Listed below are some of the top institutes offering the course in the country with the corresponding locations and fees charged by each:

| Name of Institute | City | Average Fees |

| Amity University | Noida | INR 1.5 Lacs (course) |

| Christ University | Bangalore | INR 3.2 Lacs (course) |

| University of Kerala | Kerala | INR 1 Lakh (course) |

| BS Abdur Rahman University | Chennai | INR 1.5 Lacs (course) |

| DS Actuarial Education Services (DS Act Ed.) | Mumbai | INR 81,000 (course) |

| St. Joseph's Academy of Higher Education and Research | Idukki | INR 1.28 Lacs (course) |

| Bishop Heber College | Tamil Nadu | INR 3.5 Lacs (course) |

Eligibility for M.Sc. in Actuarial Science

Listed here are the minimum criteria of eligibility that need to be met by aspiring candidates for admission to the course.

-

10+2 qualification with a minimum aggregate score of 60% in Math

- Student Membership of the Institute of Actuaries, India/UK.

- B.Sc./ B.Com. with a minimum aggregate score of 50% with Mathematics and Statistics as two of the main subjects.

| Master of Science in Andhra Pradesh | Master of Science in Arunachal Pradesh | Master of Science in Assam | Master of Science in Bihar |

M.Sc. in Actuarial Science: Admission Process

Admission to the course is based on the candidate’s performance in a relevant entrance examination conducted by the respective universities. The question paper for the exam is QMR format- based, designed to test the student’s aptitude and logical reasoning. These examinations are generally conducted in the month of April.

Here is a list of the entrance exams held in India for admission to the course:

- Actuarial science entrance exam

- Institute of Actuaries of India entrance exam

- Actuarial society of India entrance exam

M.Sc. in Actuarial Science: Syllabus and Course Description

A semester- wise breakup of the course’s syllabus is tabulated below.

Semester I |

| Holistic Education |

| Financial Mathematics |

| Probability and Mathematical Statistics |

| Managerial Economics |

| Corporate Finance and Financial Reporting |

| Financial Markets and Services |

Semester II |

| Financial Mathematics – II |

| Probability and Mathematical Statistics |

| Financial Economics – I |

| Corporate Finance and Financial Reporting - II |

| Life Insurance and Pensions |

Semester III |

| Actuarial Modelling |

| Pensions and Other Retirement Benefits |

| Life Contingencies |

| Statistical Methods and Models |

| Financial Economics - II |

Semester IV |

| Life Contingency – II |

| Health Insurance and Enterprise Risk Management |

| Actuarial Applications Using Excel and VBA Macros |

| Research Methodology |

| Actuarial Modelling - II |

M.Sc. in Actuarial Science: Career Prospects

Successful postgraduates of the program find lucrative job opportunities as Actuaries, Risk Managers for insurance companies, Financial Specialists for businesses, Consultants, Bank and Consultation Bureau personnel, Investment Professionals, among others.

Some of the popular professional avenues open to such postgraduates are listed below with the corresponding salaries offered for the respective positions.

| Job Position | Job Description | Average Annual Pay Scale in INR |

| Actuary | An actuary has an innate capability to analyse the risk possibilities of a financial activity and mitigate the involved risks. An actuary is mostly needed in the insurance sector and pension programs where the task is to use financial theories, statistics and mathematics to study uncertain future events. | 7,62,817 |

| Accountants and Auditors | Accountants and Auditors prepare and examine financial records. They ensure that financial records are accurate and that taxes are paid properly and on time. Accountants and Auditors assess financial operations and work to help ensure that organizations run efficiently. | 2,34,080 |

| Budget Analysts | Budget Analysts help public and private institutions organize their finances. They prepare budget reports and monitor institutional spending. | 3,55,717 |

| Cost Estimators | Cost Estimators collect and analyse data in order to estimate the time, money, materials, and labour required to manufacture a product, construct a building, or provide a service. They generally specialize in a particular product or industry. | 5,00,505 |

| Economists | Economists study the production and distribution of resources, goods, and services by collecting and analyzing data, researching trends, and evaluating economic issues. | 6,87,845 |

| Financial Analysts | Financial Analysts provide guidance to businesses and individuals making investment decisions. They assess the performance of stocks, bonds, and other types of investments. | 3,55,717 |

| Insurance Underwriters | Insurance Underwriters decide whether to provide insurance and under what terms. They evaluate insurance applications and determine coverage amounts and premiums. | 3,87,832 |

| Mathematicians | Mathematicians conduct research to develop and understand mathematical principles. They also analyze data and apply mathematical techniques to help solve real-world problems. | 12,87,832 |

| Postsecondary Teachers | Postsecondary Teachers instruct students in a wide variety of academic and career and technical subjects beyond the high school level. They also conduct research and publish scholarly papers and books. | 9,13,657 |

Admission Criteria

- Candidate will be shortlisted for admission to above-mentioned UG courses based on the rank and marks secured in the university entrance examination.

- According to the rank list, candidates will be eligible for the seats allocated to all colleges/institutions under State merit, reserved quotas and communal reservation seats.

Eligibility Criteria

Aspirants seeking admission to 2-year M.Sc Program should be a graduate in relevant stream from a recognized university or equivalent.

| Year (2019 - 2020) | 1 | 2 |

|---|---|---|

| Tuition fees | ₹7200 | ₹7200 |

| Admission fees | ₹6200 | - |

| Registration fees | ₹4600 | - |

| Exam fees | ₹1800 | ₹1800 |

| other fee | ₹400 | ₹400 |

| Yearly Fees | ₹20,200 | ₹9,400 |

Course Finder

Search from 20K+ Courses and 35+ Streams

![Mahatma Gandhi University - [MGU]](https://images.collegedunia.com/public/college_data/images/logos/1451886944633940151102889885_MGU Dubai.png?tr=h-71.7,w-71.7,c-force)

![St. Berchmans College - [SBC]](https://images.collegedunia.com/public/college_data/images/appImage/1549101688cover.jpg?tr=h-111.44,w-263,c-force)

![Bishop Chulaparambil Memorial College for Women - [BCM]](https://images.collegedunia.com/public/college_data/images/appImage/665_BCMWOM_APP.jpg?tr=h-111.44,w-263,c-force)

![Deva Matha College - [DMC] Kuravilangad](https://images.collegedunia.com/public/college_data/images/appImage/1034_DEVMATHACOL_APP.jpg?tr=h-111.44,w-263,c-force)

![Mahatma Gandhi University, School of Technology and Applied Sciences - [STAS]](https://images.collegedunia.com/public/college_data/images/logos/139808070014980.JPG?tr=h-72,w-72,c-force)

![University College of Engineering, Mahatma Gandhi University - [UCE]](https://images.collegedunia.com/public/college_data/images/logos/139410329528246.png?tr=h-72,w-72,c-force)

![Mahatma Gandhi University, School of Distance Education - [SDE]](https://images.collegedunia.com/public/college_data/images/logos/1455188125logonew.jpg?tr=h-72,w-72,c-force)

![Mahatma Gandhi University, School of Medical Education - [SME]](https://images.collegedunia.com/public/college_data/images/logos/1455533282mglogo.png?tr=h-72,w-72,c-force)

![Mahatma Gandhi University, School of Indian Legal Thought - [SILT]](https://images.collegedunia.com/public/college_data/images/logos/1455883109logo.jpg?tr=h-72,w-72,c-force)

![Mahatma Gandhi University, School of Management & Business Studies - [SMBS]](https://images.collegedunia.com/public/college_data/images/logos/145594464621-mahatmagandhiuniversitykottayam.jpg?tr=h-72,w-72,c-force)

![Mahatma Gandhi University, School of Computer Science - [SCS]](https://images.collegedunia.com/public/college_data/images/logos/145594677321-mahatmagandhiuniversitykottayam.jpg?tr=h-72,w-72,c-force)

![Department of Pharmaceutical Science, Mahatma Gandhi University - [DPS]](https://images.collegedunia.com/public/college_data/images/logos/1541244528MGU.png?tr=h-72,w-72,c-force)

![Central Institute of Fisheries Education - [CIFE]](https://images.collegedunia.com/public/college_data/images/logos/1415019042images.jpg?tr=h-72,w-72,c-force)

![Jyoti Nivas College - [JNC]](https://images.collegedunia.com/public/college_data/images/logos/1512457897images.png?tr=h-72,w-72,c-force)

![Jamal Mohamed College - [JMC]](https://images.collegedunia.com/public/college_data/images/logos/1427717448jiiiiiiii.jpg?tr=h-72,w-72,c-force)

![Modern College of Arts Science and Commerce - [MCASC] Shivajinagar](https://images.collegedunia.com/public/college_data/images/logos/1419512248logo1.gif?tr=h-72,w-72,c-force)

![The Oxford College of Science - [TOCS]](https://images.collegedunia.com/public/college_data/images/logos/13977342696988.JPG?tr=h-72,w-72,c-force)

![CT University - [CTU]](https://images.collegedunia.com/public/college_data/images/logos/1520663115Logo.png?tr=h-72,w-72,c-force)

Comments